7 Groundbreaking Drive-Thru Concepts and Trends for QSRs in 2024

SVP, Engineering

7 Groundbreaking Drive-Thru Concepts and Trends for QSRs in 2024

Introduction

What’s Propelling Restaurant Drive-Thru Innovations?

The first-ever restaurant drive-thru concept was launched way back in 1947. Red’s Giant Hamburg drive-thru allowed customers to drive up to a window to place orders and receive their food. Since then drive-thrus have consistently delivered a significant chunk of the revenue in the QSR (Quick Service Restaurant) category.

COVID-19 has accelerated the need for restaurants to have a comprehensive drive-thru strategy in place and focus on drive-thru innovation. This was primarily driven by:

- Heightened anxiety about health and safety

- Need for greater convenience and flexibility to order food

By the end of 2021, every major restaurant brand reported significant drive-through sales growth and drive-thru accounted for 52% of the customer traffic share for QSRs.

This trend is not just restricted to QSRs. Even full-service chains, cafes, and pizzerias that have traditionally invested in dine-in spaces are expanding drive-thru options for customers. Recently, Applebees revealed that they are planning to aggressively roll out drive-thrus to strengthen off-premise service capability.

Source: Dine Brands Global, Inc.

Speed of Service

-

Upgraded online and mobile ordering

-

AI-driven digital menu and order confirmation boards

-

Bluetooth sensors and mobile apps for personalized drive-thru experience

-

Diverse mobile and online payment options

-

Dynamic menu and menu rationalization based on complexity and inventory

-

Kitchen automation

Employee Interaction

-

Gamification to improve employee engagement

-

Video management systems to access customer interaction videos for training

-

POS with forced prompts or modifiers to upsell related items or premium toppings

-

Automated check-in alerts for employees to serve customers with pre-orders

Order Accuracy

-

Computervision to track order assembly and packaging

-

Advanced speakers and microphones with noise suppression technology

-

Secure identity validation at drive-thru pickup window

In 2024, having a drive-thru is no longer a secondary growth strategy. QSRs that had already bet big on drive-thru services are now accelerating drive-thru automation to tackle one of the biggest challenges to running a profitable restaurant – wage and commodity inflation.

1. Expanded Drive-Thru Lanes

Source: Taco Bell

Brands like Panera, McDonald’s, Burger King, and KFC are rolling out updated restaurant designs with increased drive-thru capacity and smaller dine-in areas.

Adding additional lanes is not the only option to increase drive-thru throughput. Tim Hortons has launched tandem drive-thrus that come with two sets of digital menu boards and intercom in a single lane designed to take orders from two cars at a time.

Source: Tim Hortons

Adding additional drive-thru lanes can be challenging as restaurants have to proactively address points of customer friction, manage traffic volumes, and enable seamless integration with POS systems.

Here is an extract from an article that summarizes the real-world challenges that Schlotzsky’s experienced when they piloted a double-drive-thru, with one drive-thru on each side of the restaurant.

Source: Schlotzskys.com

“When you have two menu boards where you’re taking orders at the same time, we really had to figure out how that flows through into our kitchen. And when two menu boards are taking orders at the same time, we had to equip our drive-thru make station with a headset so that they could listen to both the first drive-thru lane and the second drive-thru lane, and start the production of those products before the guests finished ordering.”

“In the early days of launching this double drive-thru, Schlotzsky’s employees had to train customers that were going to the pickup lane because the service counter is now on the passenger side, which is not what customers are used to. The store needed to go back and modify signage and striping on the asphalt to make directional flow clear to customers and improve traffic confusion.”

2. Intelligent Outdoor Digital Menu Boards (ODMBs)

Source: Acrelec.com

Some of the recent innovations in personalizing the drive-thru experience include

- Digital menu boards linked to mobile apps that rely on the phone’s location data to trigger menu board personalization when the customer drives up to the restaurant location.

- Speciality Bluetooth devices integrated with the drive-thru speaker post to trigger menu board personalization, enable the customer to redeem reward points, and make payments using their mobile phone.

- Machine learning-driven menu boards not only suggest a personalized menu based on the purchase history, external factors (such as the weather), or daypart, but also optimize the menu to eliminate order processing complexity.

McDonald’s implemented Dynamic Yield’s personalization platform to offer a dynamic menu at their drive-thrus. In the US, McDonald’s is able to show menu items based on factors such as time of day, real-time restaurant traffic information, and popularity to help provide an enhanced customer experience.

Restaurant Brands International, the parent company of QSR brands such as Burger King, Tim Hortons, and Popeyes had already started rolling out personalized ODMBs in 2021 across thousands of locations.

Source: Restaurants Brands International

3. Gamification for Drive-Thru Employees

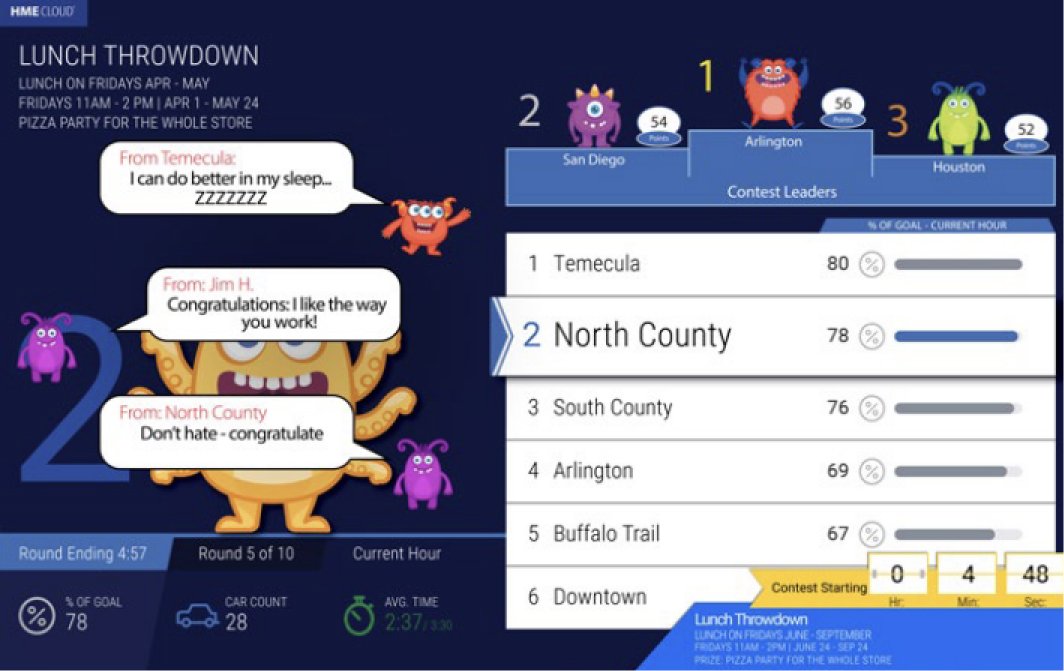

HME’s ZOOM Nitro’s drive-thru optimization system allows restaurants to gamify drive-thru service for engaging employees.

SourceHere are some of the ways gamification can improve employee engagement and productivity:

- Drive-thru leader boards can show where employees stand compared to their colleagues and introduce a positive competitive spirit at work.

- Restaurant chains can conduct friendly contests between locations with bragging rights and offer rewards as an upside for top-performing locations.

- As critical metrics are now transparent and available for all employees in real-time, employees readily take ownership of performance improvement plans.

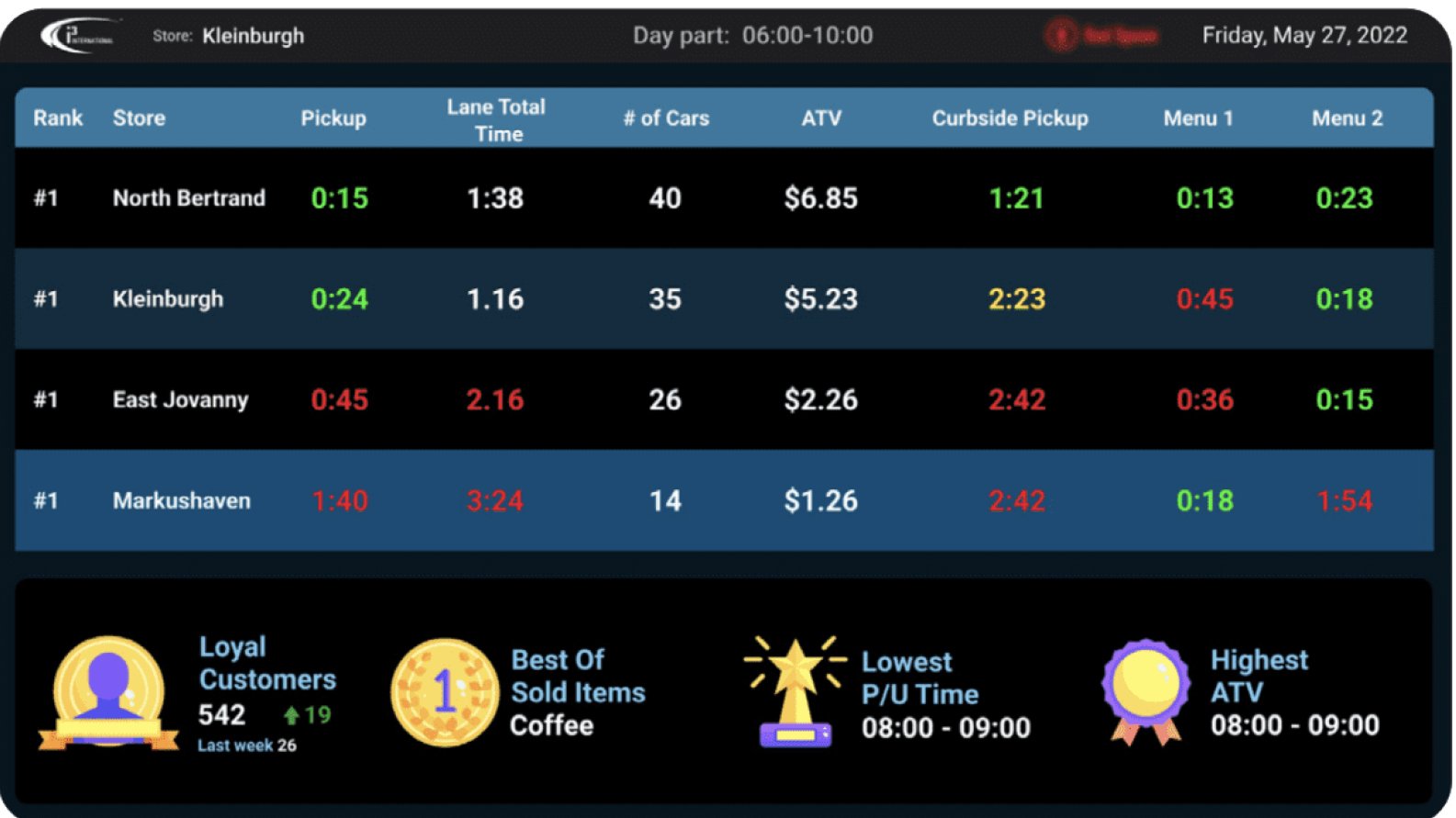

I3 International’s drive-thru leaderboards offer real-time performance snapshots of drive-thru employees giving employees and restaurant managers a live drive-thru customer service performance update.

Source: i3 International

4. Computer Vision and Video Analytics at the Drive-Thru

Video feeds from the cameras in the drive-thru area can be analyzed by computer vision algorithms in real-time to improve sales, improve order accuracy, reduce chargeback claims, flag food safety issues, and track line dropouts before purchase.

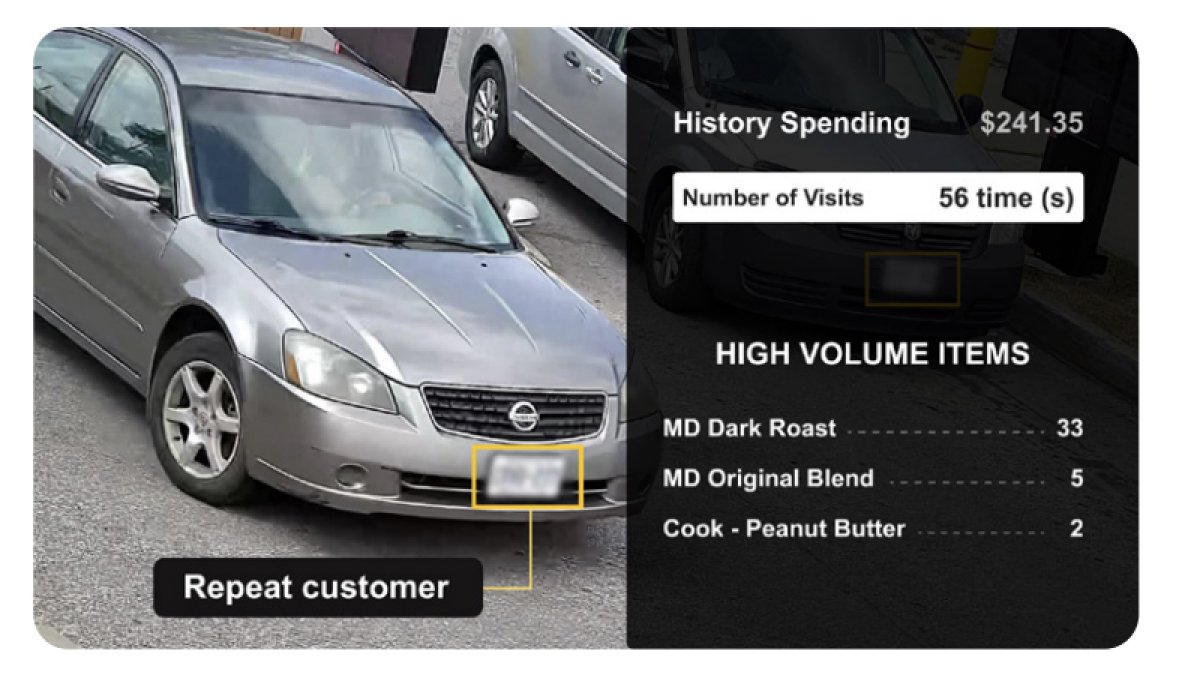

- Computer vision can read license plates of cars and even identify the age profile of the occupants inside the car. This data is useful to recognize repeat customers and show a personalized menu or offer exclusive perks as the customer pulls into the drive-thru digital menu post.

Video cameras can identify repeat customers at the drive-thru by reading the registration plates

Source: i3 International2. Ensuring order accuracy has a direct impact on sales performance and customer loyalty. Computer vision and AI applications connected to cameras in the kitchen can pinpoint mismatches in order assembly before the items are delivered to the customer.

3. In addition to identifying customers, computer vision can track drive-thru line dropout data. This information when mapped to dayparts, locations, weather, and day of the week can uncover valuable insights for QSRs. These insights can help restaurants optimize menu complexity and staffing, or even re-design the drive-thru lanes.

Presto Vision’s software allows restaurants to improve drive-thru sales and delight customers.

Source5. AI-Based Voice Assistance

Voice is a critical component of the drive-thru customer experience, and hence more QSRs are investing in installing advanced two-way audio communication systems at the drive-thrus that are designed to

- Reduce outbound (kitchen noise) and inbound noise (traffic or engine sounds), to improve order accuracy and eliminate delays due to miscommunication or poorly understood order details.

- Use automated audio alerts for employees to manage customers at the drive-thru, curbside pickup slots, or 3rd-party delivery pickups.

With AI-enabled voice technology, voice can now go beyond just improving communication. It can potentially reduce the need for employees to handle all the drive-thru transactions. This is especially useful in a tough labor market where staffing and retention are significant challenges confronting QSRs. Here are the various ways AI-enabled voice automation is being used by QSRs and fast-casual restaurants.

- Chipotle had already rolled-out Amazon Alexa reordering skill way back in 2019 for Chipotle customers who are already a part of the loyalty program. They later expanded AI-based voice ordering for phone orders as well. With the recent roll-out of dedicated drive-thru pick-up windows (aka Chipotlanes), Chipotle customers who order ahead using voice or app can drive up to the pickup window and drive out in under 12 seconds.

- In 2019, McDonald’s acquired Apprente, an AI-based technology that can engage in conversations with humans to improve drive-thru order accuracy. McDonald’s piloted the technology in 2021 at 24 drive-thrus in the Chicago area and reported about an 80% success rate. The technology is being further tested and upgraded with the help of IBM before a system-wide roll-out.

- Wendy’s is leveraging Google Cloud to roll out a combination of AI-enabled voice technology along with computer vision that’s designed to take orders at the drive-thrus and send the transcribed order details directly to the kitchen and POS.

6. Automated Drive-Thru For App Orders

“McDonald’s is piloting a drive-thru concept that completely eliminates the need to have any customer-facing staff. Customers who choose to dine in, place orders via self-service kiosks, and robots bring the order from the kitchen. For those who want to use the drive-thru, the only option available is by ordering ahead via the app.

When customers order ahead via the McDonald’s app with push notifications enabled and location access turned on, food preparation is timed to the customer’s estimated pick-up time. Once the customer reaches the restaurant, they pull into the order ahead drive-thru lane to pick up their order that’s delivered via conveyor belt.

McDonald’s is piloting an automated order ahead drive-thru lane at one of their Texas locations.

Source: McDonald’s

7. Restaurant Robotics & Future Contactless Drive-Thru

The National Restaurant Association (NRA) paints a grim view of the labor shortages that continue to plague the restaurant industry in the US. According to NRA, “Despite the steady employment gains during the last 2 years, eating and drinking places are still 450,000 jobs (or 3.6%) below their pre-pandemic staffing levels. That’s the largest employment deficit among all U.S. industries.” To combat this challenge, some restaurants have already started deploying robots not only for kitchen automation but also for customer service. It’s just a matter of time before drive-thru customers have an entirely contactless experience when kitchen automation and service automation technologies mature.

A new crop of restaurant robot companies have all graduated their products from the design or prototyping phase to deployment at restaurants.

- Robotic Arms – Ally, Nala, Miso

- Bartender Robots – Makr Shakr, Cecilia.ai

- Bowls and Salad Maker Robots – Chowbotics, Spice, Beastro, Autec

- Food Delivery Robots – Starship, Neuro, Kiwibot

- Robot Waiters – Bellabot, Matradee, Servirobot

- Pizza Robots – Picnic, Piestro, Zume

- Coffee Shops – Cafex, Rozum, Artly, CookRight

Prominent restaurant brands are piloting robots or have already deployed them in the first set of locations.

Sweetgreen launched its Infinite Kitchen technology at its Naperville, Illinois restaurant which leverages automation to dispense greens and other ingredients precisely in bowls moving along in an assembly line.

Other established restaurant brands such as Chipotle, White Castle, and Wing Zone have all deployed Flippy, a kitchen robot that automates fast food preparation.

New restaurant brands are launching in 2024 that have embraced an automation-first strategy. For example, Steve Ells, the former CEO of Chipotle is launching a new chain named “Kernel” in the New York area in 2024. Every location will have just 3 employees supported by robots.

We expect these technologies to find a way to the drive-thru in late 2024 or in 2025 as the technology is perfected and real-world ROI is established.

Groundwork Needed for Drive-Thru Innovation

1. Network Capacity

Designing the physical space and logistics of managing the traffic often takes center stage in drive-thru design while the network side of the solution may take a backseat. Network design and capacity to support mobile POS transactions, sophisticated IP cameras with edge computing capabilities, intelligent ODMBs, order confirmation systems, and perimeter security sensors (such as alarm systems) play a critical role in the successful implementation of cutting-edge drive-thru concepts.

2. Network Security

3. Accidents and Claims

4. Backend Bottlenecks

5. Operational Complexity

Share this article

Innovate Fearlessly and Change Gears with Confidence

About the author

Steve Womer

SVP, Engineering

Explore more blog articles

Business Video Surveillance Insights for Loss Prevention Teams

Retail Network Transformational Insights

5 Essential Steps to Create a Lone Worker Safety Policy

Connect with Our Experts

Interface solution experts are ready to help you solve challenges. Set up a no-obligation, exploratory call now.